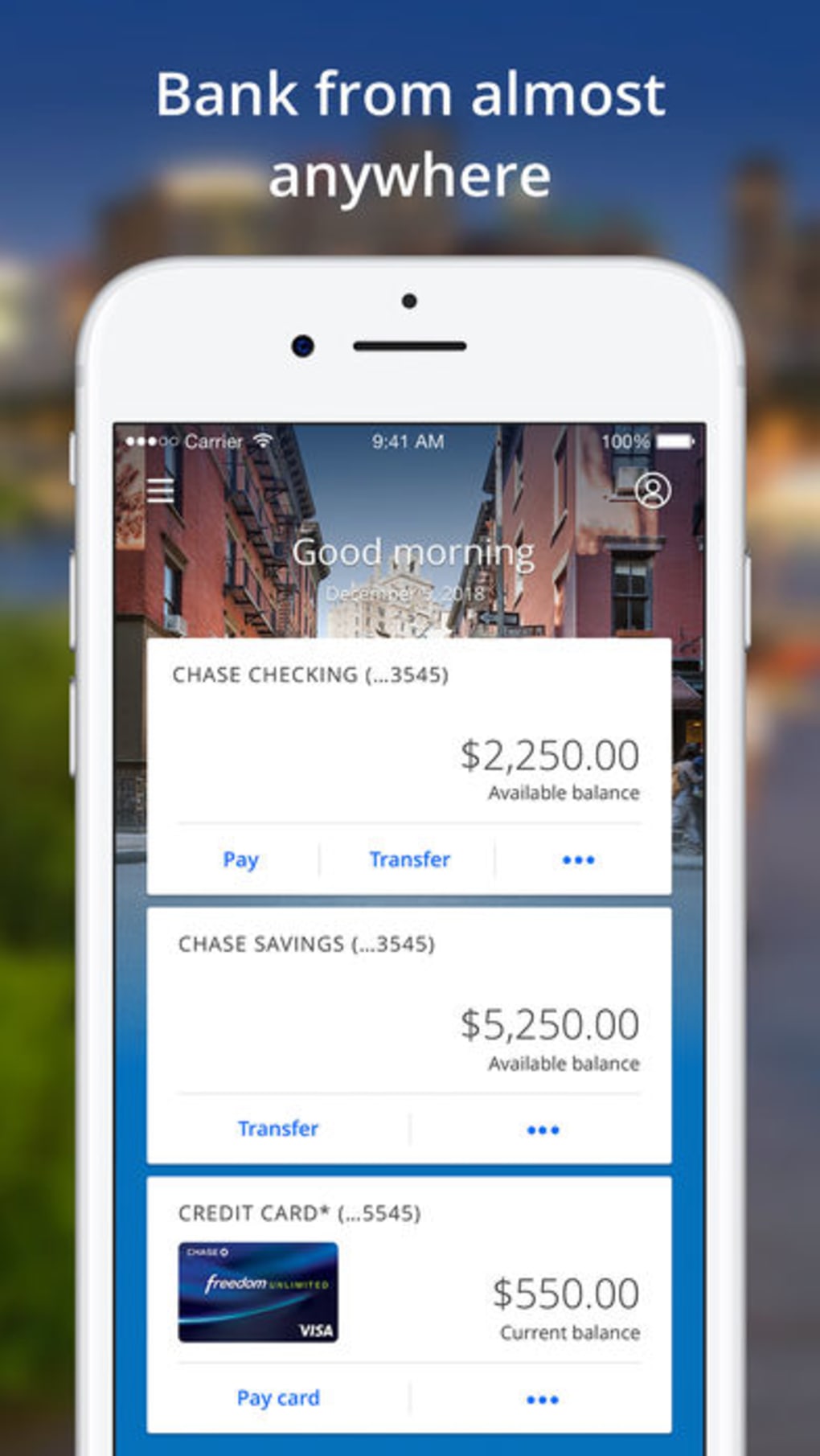

I have been using the app for several months now, and it recently saved me from what could have been a much more terrible situation. For each option the amount is up to your choosing and you specify whether you’d like to be notified by push, text, or e-mail. You can be alerted when your credit falls below a certain amount, when international charges are made, if more than a certain amount is charged to an acount, balance transfers or payments have been posted, when balances are due soon, if your balance falls below a certain amount, and many more. There are also quite a few customizable alerts and notifications that are available to your account. You can even request money from your more absent minded (or shady) friends who tend to forget they owe you some cash. It takes some quick initial setup with basic information from your friend and within minutes you can approve transfers to each other for free. You may have seen Chase touting their Quick Pay service, a fast and easy person-to-person money transferring system between two Chase customers. You can also make credit card and bill payments straight from your app, make deposits with Chase QuickDeposit, and make changes to pending transactions. Your account balance and lists of transaction histories are all viewable, and you can easily transfer money between your accounts. The app allows you to view all your accounts including checking, savings, and credit cards. Their app offers a number of convenient features and can complete most personal banking tasks. Personally, I’d give this one a miss to avoid potentially having to deal with another tax form.Chase Mobile is the mobile banking app for customers of JP Morgan Chase Bank for iPhone, iPad, and iTouch. Please consult your tax advisor if you have any questions about the impact to your personal income tax returns. You are responsible for any tax liability related to participating in this program. Source Income Subject to Withholding) for the year in which the income is paid. Your participation in this program may result in miscellaneous income and may be reportable to you and the IRS, on a Form 1099-MISC (miscellaneous income) or Form 1042-S (Foreign Person’s U.S.To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.After qualifying, please allow 6 to 8 weeks for the statement credit to post to your account.Statement credit will appear on your statement as a stand-alone transaction independent of any purchase transaction.Limit (1) $5 statement credit per customer or card account.To qualify for and receive your bonus, sign in to the Chase Mobile app by 08/31/19.You will receive a $5 statement credit with this bonus offer.

0 kommentar(er)

0 kommentar(er)